One of the more common letters sent out by the IRS is Notice CP501. This notice acts as the first step by the IRS to collect on money that is due. It is the equivalent of a company sending a reminder that you have an unpaid invoice. While this is only the first step in the collections process, it is important to address the notice now, and not wait.

Why did I get this Notice?

The IRS sent you this notice because you have a past due tax debt according to their records. You may have filed a return showing an amount owed and never paid it. The IRS could have corrected your return and the correction resulted in a new balance owed. The IRS may have audited you and the result of the audit was a balance due. Or, the IRS may have created a return for you.

Whether it is for one of the reasons above, or something completely different, the IRS believes that you have taxes that are not yet paid. The Notice CP501 is the first reminder to pay that balance.

Anatomy of a CP501

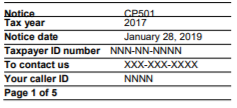

While the full notice can be several pages long, the most crucial information is on the first page. At the top of the first page is a header that will be repeated on all pages.

In the header, you will find

- the notice number, in the present case that number is “CP501,”

- the tax year or years that are at issue, 2017 here,

- the notice date, this is important as we will see later, January 28, 2019,

- taxpayer identification number, either SSN or FEIN,

- contact number, and

- your caller ID.

This section is important for several reasons. First, you should make sure that you are the intended target. If the SSN or FEIN does not belong to you or your spouse, then you should contact the IRS to let them know that you are not the taxpayer they are looking for. Second, the contact number and caller ID are required if you contact the IRS about this notice. Third, the tax years will help you understand which year or years are at issue when trying to resolve the problem.

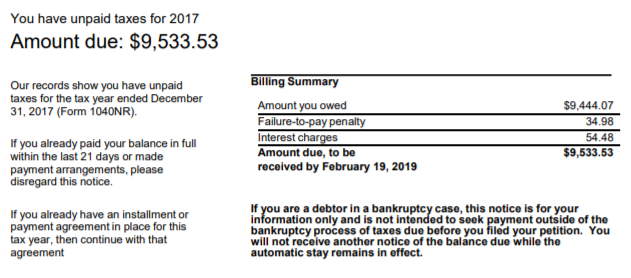

The body of the first page will give you more information about how much is owed. This amount is shown as a total and broken down by tax, interest, and penalties. This section will also tell you how long you have to pay the balance before the IRS moves to the next step in the collections process. Here, the penalties and interest are calculated through February 19th, and the balance shown is only accurate through that date. After that date, you will owe even more.

What Should I Do?

You have essentially two options at this point. You can either pay the amount, in full, or through a payment plan, or argue it. If you believe the amount is correct, you should either pay it, or set up a payment plan. If you disagree, then you need to document why you think the amount is incorrect and present that to the IRS.

The worst possible thing you can do is to ignore this letter. If you do not pick one of the options above, the IRS will proceed with collections and potentially start seizing your property, including money in your bank account.

If you have received a CP501, contact us today to discuss your options.