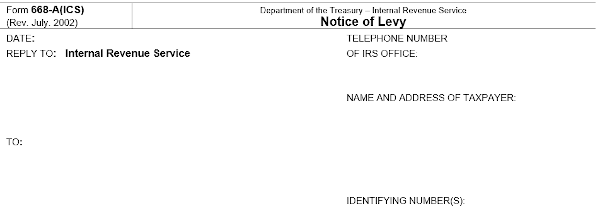

Last week, we looked at CP504, the warning the IRS gives before issuing a levy. This week, we are looking at Form 668-A. The IRS will send this form to both the taxpayer and the business that will have to turn over the taxpayer’s property, such as a bank. If you received a Notice CP504 and ignored it, Form 668-A is one of the consequences.

The Anatomy of Form 668-A

Form 668-A starts by identifying the taxpayer by name and address. This is similar to most other notices and letters from the IRS, but now it is not only going to the taxpayer, but also a business that is associated with the taxpayer, such as a bank.

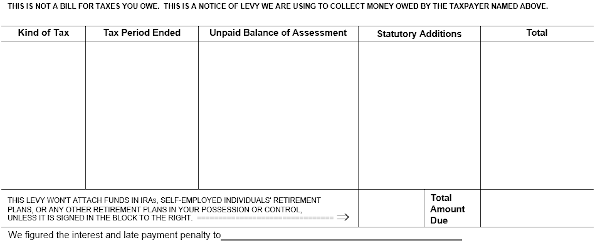

The body of the notice is information identifying the type of tax, dates that are at issue, and the amount that is owed. If the levy is issued to a bank, and the taxpayer’s account has more than that amount, then the bank is only supposed to remit enough to cover the balance. However, if the amount owed is more than the amount in the taxpayer’s account, the bank must turn over all of the funds in that account.

Below that section are instructions for the bank to hold the money and assets for 21 days and then remit it to the IRS.

What should I do?

You only have 21 days to respond to the levy action. During those 21 days, you either need to pay the amount owed, make arrangements to pay it off, such as an installment agreement or argue why the amount stated is incorrect at a Collections Due Process Hearing.

If you have received Form 668-A, contact us today to discuss your options.