We recently discussed the differences between a lien and levy here, but how do you know when the IRS will levy your property? Before levying a taxpayer’s property, the IRS must notify the taxpayer of the outstanding balance and the pending levy action. This is potentially the last opportunity a taxpayer has before the IRS starts taking property.

Anatomy of CP504

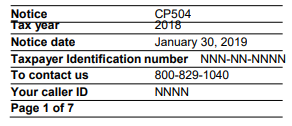

While the full notice can be several pages long, the most crucial information is on the first page. At the top of the first page is a header that will be repeated on all pages.

In the header, you will find

- the notice number, in the present case that number is “CP504,”

- the tax year or years that are at issue, 2018 here,

- the notice date, this is important as we will see later, January 30, 2019,

- taxpayer identification number, either SSN or FEIN,

- contact number, and

- your caller ID.

This section is important for several reasons. First, you should make sure that you are the intended target. If the SSN or FEIN does not belong to you or your spouse, then you should contact the IRS to let them know that you are not the taxpayer they are looking for. Second, the contact number and caller ID are required if you contact the IRS about this notice. Third, the tax years will help you understand which year or years are at issue when trying to resolve the problem.

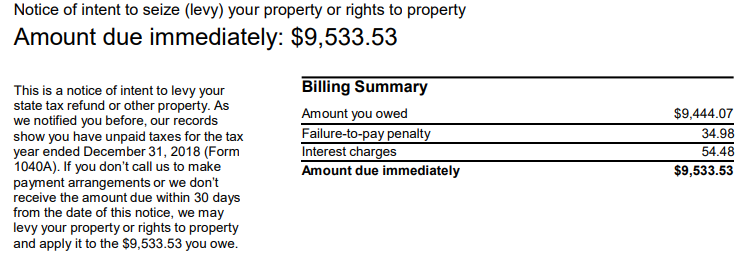

The body of the first page will give you more information about how much is owed. This amount is shown as a total and broken down by tax, interest, and penalties. As noted in this section, you will have 30-days from the Notice Date (in the header) to act. This does not mean that you have 30 days from the time that you receive the notice. If the mail is running slow, you may only have a couple of days to act.

What can you do?

At this point, you still have a few options.

If you believe the stated amount owed is incorrect and have not had a chance to present your side, then now is the time to do so.

If you either believe the amount is correct (or have previously agreed to pay that amount), and you can pay it in full, then follow the directions to make full payment immediately.

If you cannot pay the total amount now, you can set up a payment plan or possibly qualify for an offer-in-compromise.

The worst possible thing you can do is to ignore this letter. If you do not pick one of the options above, the IRS will proceed with the levy and potentially start seizing your property, including money in your bank account.

If you have received a CP504, contact us today to discuss your options.